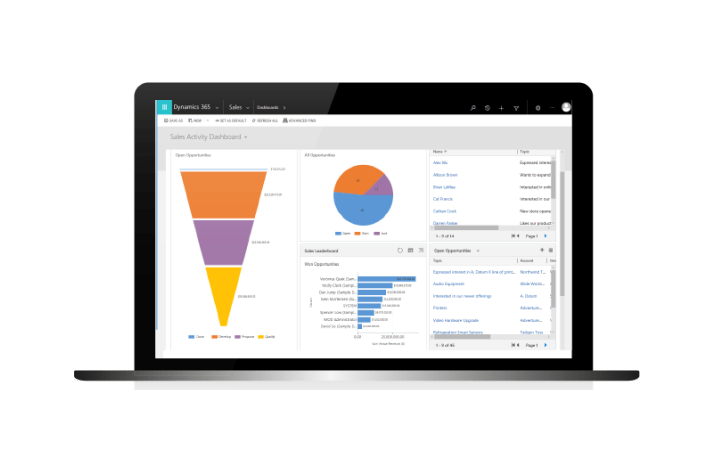

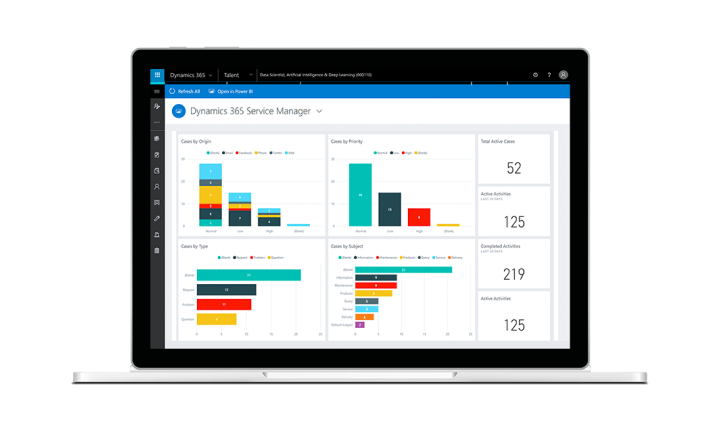

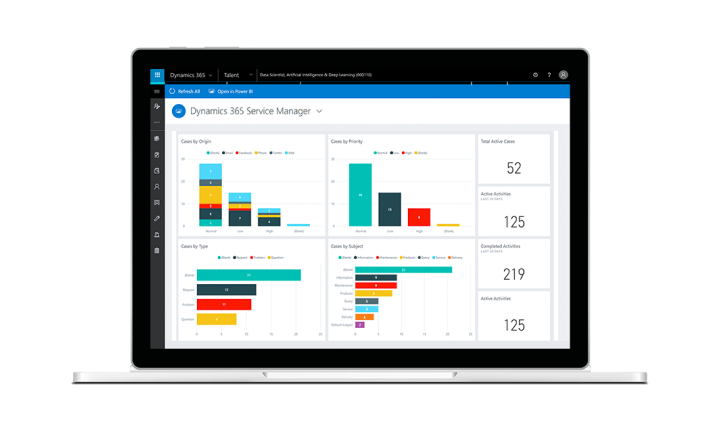

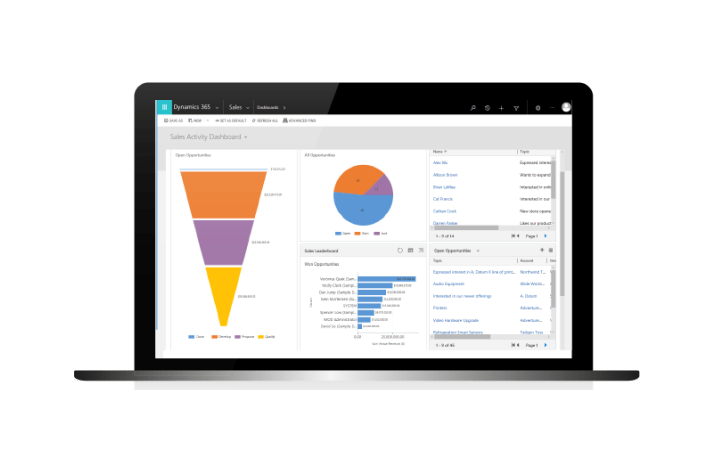

We use custom CRM solutions like Microsoft Dynamics 365 Sales and Salesforce Sales Cloud to streamline your banking and finance operations. These solutions are designed specifically to guide you through the complex sales cycle, from the first customer interaction to the final deal, allowing you to optimize efficiency and accuracy at every critical point.

CRM

From lead to contract!

Banking Accelerator

The Banking Accelerator, an integral part of the Microsoft Dynamics 365 platform, is a pre-built industry solution for finance and banking companies, meticulously designed to streamline implementation with its pre-configured business processes and data models, all aimed at delivering maximum value.

In practice, the Banking Accelerator speeds up lead management, improving lead capture and conversion. Its integrated data model enables a complete financial view of the customer, facilitating tailored offers. In addition, its automated contract management process simplifies contract generation and signing, reducing manual work and improving accuracy.

ERP Integration

Real-time data visibility: As a leading provider of cutting-edge solutions, we offer financial and banking companies a complete ERP integration solution using advanced technologies. This integration enables companies to automate and optimize vital financial, supply chain, and core business operations, giving them real-time data visibility.

Business Apps

Credit and Banking Products

We specialise in creating unique business applications for the financial and banking sector. Our credit and banking products streamline credit and banking operations, providing features such as loan origination and management, collateral tracking, and powerful reporting. Designed for ease of use, these products integrate seamlessly with industry-leading platforms such as Microsoft Dynamics 365, SAP, Salesforce, and Fintech, providing secure real-time data visibility

Validation for B2B and B2C

Our data validation tailored for both B2B and B2C companies in real-time ensures accuracy, reduces errors, and minimizes fraud risks, while providing customization to meet specific business needs. Whether we’re verifying partners and suppliers for B2B or authenticating customer information for B2C, our solutions improve decision-making and security in a rapidly evolving marketplace.

Security – On-Premises – Hybrid Setup

As businesses move to the cloud, security becomes a top priority. Our hybrid configuration provides the perfect balance, delivering the benefits of cloud computing while ensuring data security. Our business applications provide a secure and scalable platform whether you’re at your desk or on the go, ensuring your confidence in an ever-evolving business world.

Some of the automation for the Finance and Banking sector include:

Data extraction with OCR

This solution, based on optical character recognition (OCR), seamlessly extracts data from invoices and meticulously matches it to purchase orders using advanced algorithms and pattern recognition techniques.

Thus, our solution minimizes manual tasks up to 90%, saving time and reducing the risk of errors, ensuring accurate processing.

Accurate data collection and verification

Utilizing advanced data collection and verification methods, our bots automate the process of gathering and verifying borrower information, ensuring accuracy, and reducing the possibility of errors.

Innovative automation for bank statement conciliation

We have successfully implemented automation in bank statement conciliation. Our innovative bot can automatically download bank statements and compare them to the recorded transactions in the company’s accounting system. Any discrepancies are flagged for review, saving valuable time and reducing the possibility of errors.

Real-time loan term calculation with innovative algorithms

Our innovative algorithms enable real-time loan term calculations, empowering financial institutions to make swift, informed decisions. We streamline the loan approval process by generating essential documentation, delivering a superior experience for both institutions and borrowers.

CRM solutions

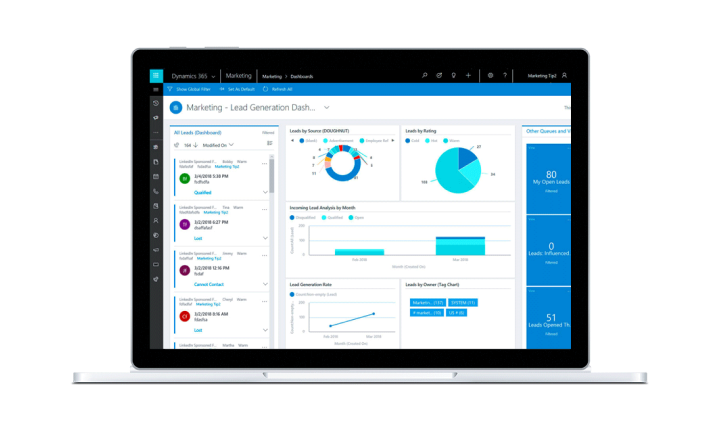

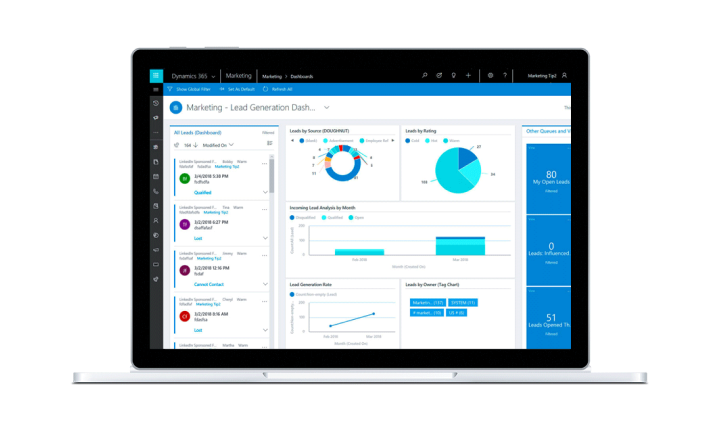

Marketing for B2C

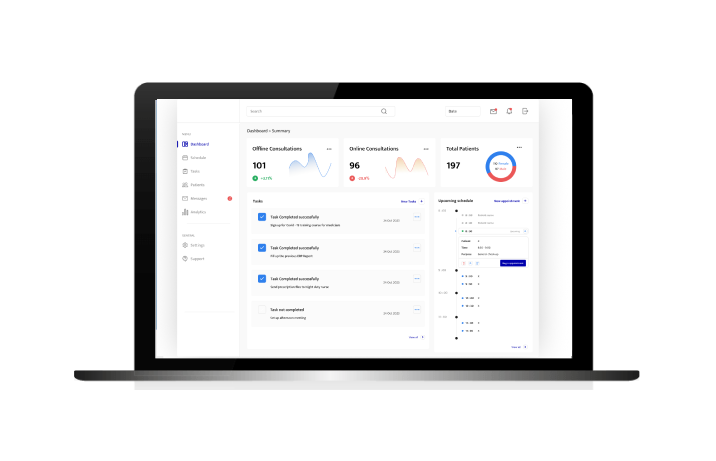

We use Microsoft Dynamics 365 Marketing and Salesforce Marketing Cloud, which provide valuable patient insights, streamline campaigns, and deliver personalized healthcare experiences, all of which help increase patient engagement and business success.

Sales for B2B

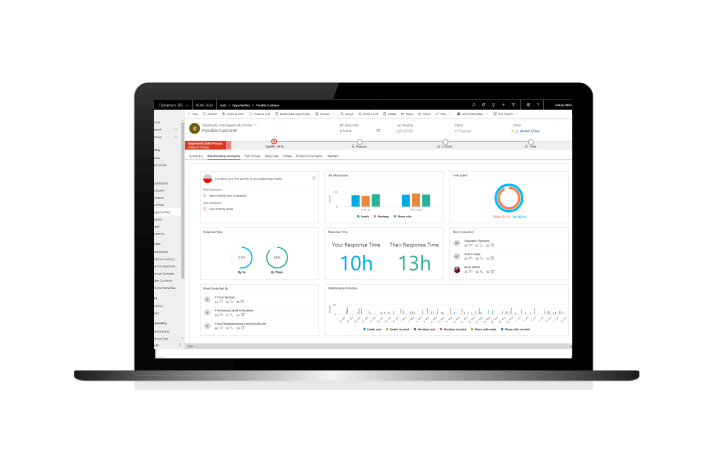

From lead generation to post-sales follow-up, our CRM solutions, powered by Microsoft Dynamics 365 Sales and Salesforce Sales Cloud, provide a comprehensive view of every sales interaction, enabling streamlined processes, improved customer relationships, and growth.

Key features include lead and opportunity management, accurate sales forecasting, and detailed reporting and analytics, enabling healthcare B2B sales teams to improve efficiency and productivity while achieving their sales goals.

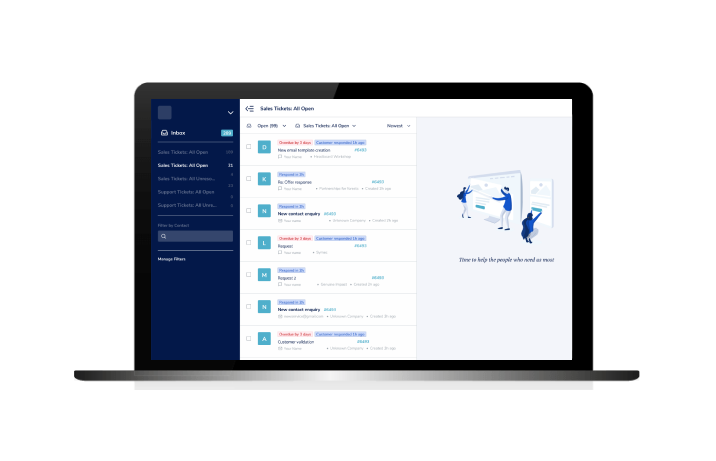

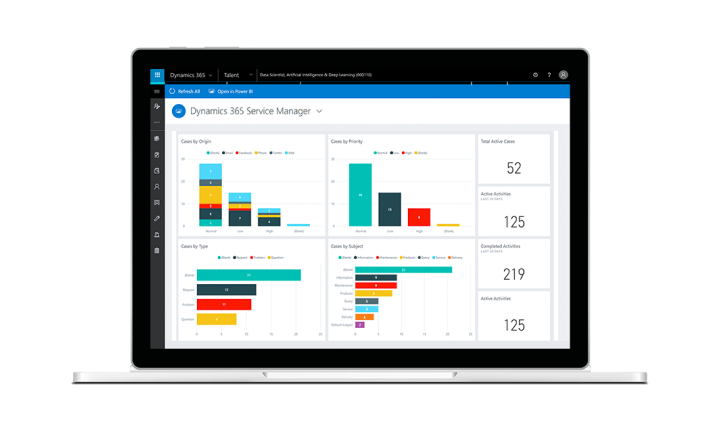

Service for top customer

Using our CRM solutions, based on Microsoft Dynamics 365 Service or Salesforce Service Cloud, healthcare providers can deliver top-notch customer service, improving patient satisfaction and building stronger relationships.

Key features include contact and case management, analytics and reporting, automated notifications, knowledge management, multi-channel support, customizable dashboards, and seamless integration with existing healthcare systems.

Business Apps

Give access to clients via portals or Web apps

Increase customer efficiency with our specialized business apps. Automate ID identification, customer communication, case processing, payment verification, and contract management for accuracy and streamlined operations, ultimately improving customer satisfaction and productivity.

Replenishment of stocks

Our healthcare-focused business applications streamline inventory processes, providing real-time tracking, automated replenishment commands and seamless integration with existing systems. Ensure on-time inventory replenishment, reduce inventory, and improve patient care with our easy-to-use solutions.

Some of the automation for the Healthcare sector include:

Patient data classification

This solution involves the use of machine learning algorithms to analyze large amounts of patient data, such as medical history, symptoms, and treatment plans, to extract relevant information and classify it for easier access and processing. By automating this process, healthcare professionals can save time and effort, improving efficiency and accuracy in patient care.

Medical billing automation

This solution involves the automation of medical billing documents using machine learning algorithms. By doing so, healthcare organizations can help ensure accuracy and compliance with industry regulations while reducing the risk of human error.

Medical image analysis

The analysis of medical images, such as X-rays, CT scans, and MRIs, can be time-consuming and challenging for healthcare professionals. The solution of computer vision and deep learning algorithms can help automate this process, providing faster and more accurate diagnoses, ultimately improving patient outcomes.

Prescription drug monitoring

This solution involves the automated monitoring of prescriptions for controlled substances. By doing so, healthcare organizations can ensure compliance with regulations and identify potential cases of drug abuse or diversion. This can help to improve patient safety and reduce the risk of substance abuse.

CRM

Efficient Customer Management

Our specialized CRM solutions, using Microsoft Dynamics 365 Service and Salesforce Service Cloud, are tailored to improve interactions and payment tracking, ultimately improving collection performance.

Key features include customer segmentation, automated communication, and payment tracking. Customer segmentation provides targeted messaging, optimizing engagement and payment rates. Automated communication simplifies payment reminders and confirmations, improving the overall customer experience. Payment tracking helps businesses manage their collections process from start to finish.

Increased Operational Efficiency

Increase collection efficiency with our specialised business apps. Automate document identification, customer communication, case processing, payment verification, and contract management for accuracy and streamlined operations, ultimately improving customer satisfaction and productivity.

Business Apps

Validation for B2B & B2C

In the field of collections, we specialize in data validation in both the B2B and B2C sectors. For B2B collections, we verify and maintain accurate trade data, while for B2C collections, we ensure accurate customer information and validate the accuracy of receivables. Our automated tools speed up these processes, increasing data reliability and collection efficiency for both sectors.

Security – On-Premises – Hybrid Setup

In the collection industry, we prioritize data security. Our solutions offer practical on-premises and hybrid setups, ensuring your sensitive information remains safeguarded against unauthorized access and cyber threats. With our expertise, you can confidently protect your data while optimizing collection processes.

Some of the automation for the Collection sector include:

Payment Processing Automation

Automate payment processing to minimize errors and delays. Send automated notifications to customers regarding upcoming payments, due dates, and payment confirmations, ensuring timely collections. Experience increased operational efficiency and cost savings by reducing manual intervention and enhancing accuracy in payment handling processes.

Data Processing Automation

Automate data processing to swiftly categorize customer behavior, enabling swift identification of optimal collection paths and minimizing time spent on manual data sorting, ultimately enhancing operational productivity. This automation improves the accuracy and efficiency of data analysis.

Document Processing Automation

Implement automation for document processing tasks such as reading and processing contracts, invoices, and receipts. Take advantage of document processing automation to streamline and accelerate critical document reviews, ensuring compliance, reducing processing time and mitigating the risks associated with manual handling, ultimately leading to a more efficient workflow.

Payment Plan Automation

Automate the creation and management of payment plans for debtors. Based on predefined criteria, the system can generate custom payment plans, calculate installment amounts, and set up automatic recurring payments. This simplifies the process for debtors and reduces the administrative burden on collection agents, ensuring an easier repayment process and higher collection rates.

CRM

CRM for Marketing

We help automotive companies effectively manage potential customers, implement email marketing campaigns for vehicle launches or service promotions, and segment customers based on preferences and purchase history. By leveraging the capabilities of Microsoft Dynamics 365 Marketing and Salesforce Marketing Cloud, we ensure that automotive companies can achieve greater efficiency and drive results in a rapidly evolving market.

CRM for Service

Using Microsoft Dynamics 365 Service and Salesforce Service Cloud, we consolidate customer data, enabling efficient appointment scheduling, proactive service reminders, and rapid integration with specialized tools such as service management systems. This precision ensures that automotive service providers can deliver top-notch experiences, boosting customer satisfaction and retention.

CRM for Sales

In the automotive sector, we harness the power of Microsoft Dynamics 365 Sales and Salesforce Sales Cloud to provide a customized CRM for Sales solution. This empowers automotive companies with real-time customer data access, streamlined sales processes, and performance analytics tailored to their industry needs. Drive sales, enhance customer experiences, and stay competitive with our specialized CRM solutions for automotive sales teams.

Industry Accelerator

Industry Accelerator, based on Microsoft Dynamics 365, offers a customized solution for the automotive industry. From online appointment scheduling to work order management and customer data management, our platform increases customer satisfaction, optimizes operations, and supports data-driven decision making. Real-time reporting and DMS integration ensure a seamless customer experience while providing invaluable insights for continuous business improvements.

Bussiness Apps

Portals for B2C

In the automotive industry, our B2C sales portals serve as a single platform for managing customer interactions, sales processing, and satisfaction monitoring. These portals are tailored to the unique needs of the industry, providing real-time updates and automation of key processes. They enable automotive companies to deliver exceptional customer experiences and boost sales by personalizing interactions and centralizing sales data.

Fleet Management

Our industry-specific fleet management solutions offer real-time vehicle tracking, detailed data, and task automation for streamlined operations in the automotive sector. We specialize in ensuring compliance with regulations, improving internal communication, and helping clients make informed decisions while managing their fleets efficiently.

Some of the automation for the Automotive sector include:

Supply Chain Management

Our solution provides real-time tracking and analysis of automotive supply chain operations, seamlessly integrating with key supply chain processes including transportation, inventory management and supplier management. By providing instant data and analytics, it enables companies to improve inventory control, minimize lead times and boost overall operational efficiency, ultimately leading to reduced costs and increased market competitiveness.

Quality Control Automation

Our automated quality control system uses computer vision and machine learning to inspect automotive parts, capturing images and identifying defects such as cracks or deformations. By automating this process, faster and more accurate inspections are ensured, reducing the risk of product recalls, improving customer satisfaction and increasing profitability for automotive companies.

Production Line Optimization

Our solution uses machine learning algorithms to analyze production data, optimizing automotive production by integrating with various systems, including quality control, inventory management and machine maintenance, leading to reduced downtime and increased efficiency.

Predictive maintenance

Our solution utilizes machine learning to predict vehicle component failures, enabling proactive maintenance and cost reduction. By optimizing vehicle performance and reliability, it enhances efficiency and customer satisfaction in the automotive industry.

CRM

Transform your legal practice with our CRM solutions

Our CRM solutions provide legal professionals and law firms with effective tools for client management, workflow automation, and streamlined case management. Easily track client interactions and crucial case details, ensuring no detail is missed.

Our standout feature is task and workflow automation, allowing legal experts to focus on high-value tasks. Automate deadline reminders, schedule client follow-up, and generate invoices seamlessly.

In addition, our CRM solutions provide robust reporting and analytics, delivering valuable information for making informed decisions, optimizing resource allocation, and improving overall legal practice efficiency.

Business Apps

Legal documents platforms

Our legal document platforms simplify the creation, management, and secure storage of legal documents, reducing your investment in resources and time. They promote collaboration, integrate with business applications and support remote working, while increasing efficiency and cost-effectiveness for legal professionals.

Some of the automation for the Legal sector include:

Document understanding and classification

Our AI-based automation solutions streamline legal document management by automatically classifying and extracting information. This speeds up access to accurate data, improves efficiency and ensures regulatory compliance. Our automations include automated document classification, contract analysis, document summarization, predictive coding and duplicate document detection, tailored to your specific needs.

Document creation with dynamic content

Our document creation software with dynamic content simplifies and accelerates the creation of precise legal documents. By automating data entry through pre-populated fields and templates, we save you time while ensuring accuracy and consistency. Our solution seamlessly integrates with document understanding and classification tools, providing a comprehensive automation suite to streamline legal processes and boost efficiency.

Digital archiving

With automated digital archiving, we enable you to digitise your entire archive of legal documents, ensuring convenient access from anywhere, anytime. Our platform uses advanced machine learning and natural language processing to classify, index and tag documents, simplifying retrieval and ensuring data security in secure cloud storage. Key features include advanced categorization, secure storage, seamless integration with other document management tools, and easy remote access.

Document validation

Our customized validation solutions streamline the verification of essential legal documents such as contracts and certificates. Using cutting-edge technology, we compare information in documents with trusted sources to identify discrepancies and errors. Key features include accuracy verification, secure validation with encryption, automation to save time and reduce errors, and seamless integration with document management tools. Our solution also includes robust exception handling, ensuring accurate and reliable validation.

CRM

Sales customer insights

For the Retail industry, our CRM solutions powered by Microsoft Dynamics 365 Sales and Salesforce Sales Cloud offer tailored marketing, personalized recommendations, and optimized channel strategies based on comprehensive customer insights.

In Manufacturing, our CRM system tracks orders, delivery, and feedback, ensuring a seamless customer journey. Utilize insights to refine products and services, enhancing customer satisfaction in both Retail and Manufacturing using our CRM solutions.

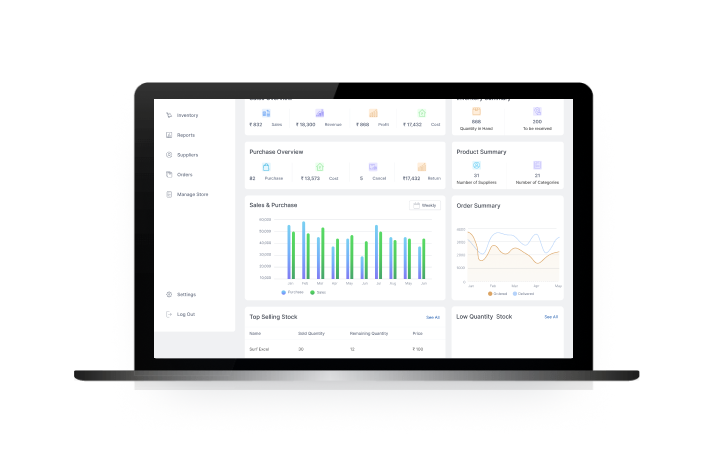

Supply chain management

In the Retail and Manufacturing sectors, we provide a comprehensive suite of supply chain management tools. These tools cover inventory management, order tracking, logistics, and distribution, and can be customized to seamlessly integrate with other systems like ERP software and e-commerce platforms. With our solutions, you gain the ability to analyze data and track key performance indicators (KPIs) for optimizing supply chain operations. By enhancing efficiency, reducing waste, and cutting costs, you can boost profitability, while also elevating customer satisfaction and loyalty.

Business Accelerator

Simplify your CRM processes with Microsoft Dynamics 365 Business Accelerator. In retail, gain real-time customer insights for targeted marketing, increased sales, and loyalty. In manufacturing, streamline supply chains, enhance communication, and reduce costs for improved customer satisfaction and competitiveness.

Some of the automation for the Retail and Manufacturing sector include:

Quality Assurance Solutions

Our QA solutions are tailored for retail and manufacturing, providing streamlined processes and real-time monitoring.These solutions elevate quality standards, ensuring efficiency and customer satisfaction.

Our customizable QA solutions optimize your operations and maintain a competitive edge in retail and manufacturing.

Sales portals

In the competitive world of retail and manufacturing sales, our Sales Portal is your essential toolkit, offering easy access to product catalogs, pricing, and promotions to empower you with timely information for success. Using this solution, you can efficiently manage customer accounts, track orders, and monitor deliveries, all from one central hub, allowing you to make data-driven decisions and optimize your product offerings.

Sales Assistants

Our AI and machine learning-based sales assistant is your virtual ally in retail and manufacturing, providing real-time support, suggesting products and guiding you through the sales process, making your decisions more informed and efficient. You can instantly access vital product details, pricing and promotions with our sales assistant, enabling quick responses to customer queries and orders, allowing you to invest more time in cultivating customer relationships.

Assembly line assistants

This assistant ensures precise component assembly, adherence to quality standards, and offers real-time progress updates for quick issue resolution, all while providing valuable insights to optimize processes, identify bottlenecks, and enhance workplace safety.

It uses advanced technologies, such as machine learning, to minimise errors and delays, leading to higher quality products and satisfied customers.