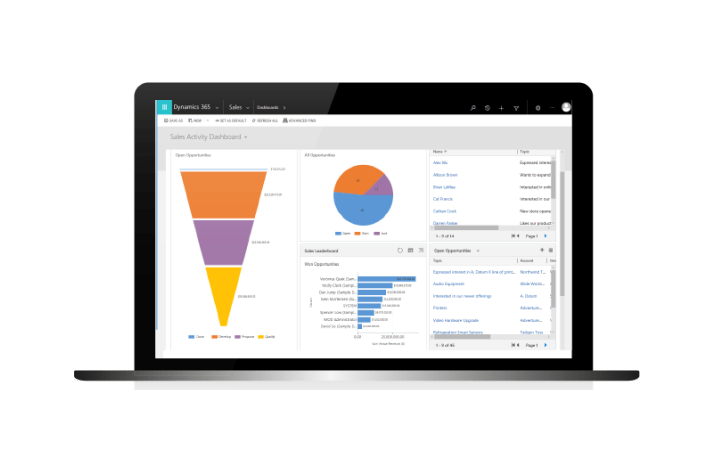

We use custom CRM solutions like Microsoft Dynamics 365 Sales and Salesforce Sales Cloud to streamline your banking and finance operations. These solutions are designed specifically to guide you through the complex sales cycle, from the first customer interaction to the final deal, allowing you to optimize efficiency and accuracy at every critical point.

CRM

From lead to contract!

Banking Accelerator

The Banking Accelerator, an integral part of the Microsoft Dynamics 365 platform, is a pre-built industry solution for finance and banking companies, meticulously designed to streamline implementation with its pre-configured business processes and data models, all aimed at delivering maximum value.

In practice, the Banking Accelerator speeds up lead management, improving lead capture and conversion. Its integrated data model enables a complete financial view of the customer, facilitating tailored offers. In addition, its automated contract management process simplifies contract generation and signing, reducing manual work and improving accuracy.

ERP Integration

Real-time data visibility: As a leading provider of cutting-edge solutions, we offer financial and banking companies a complete ERP integration solution using advanced technologies. This integration enables companies to automate and optimize vital financial, supply chain, and core business operations, giving them real-time data visibility.

Business Apps

Credit and Banking Products

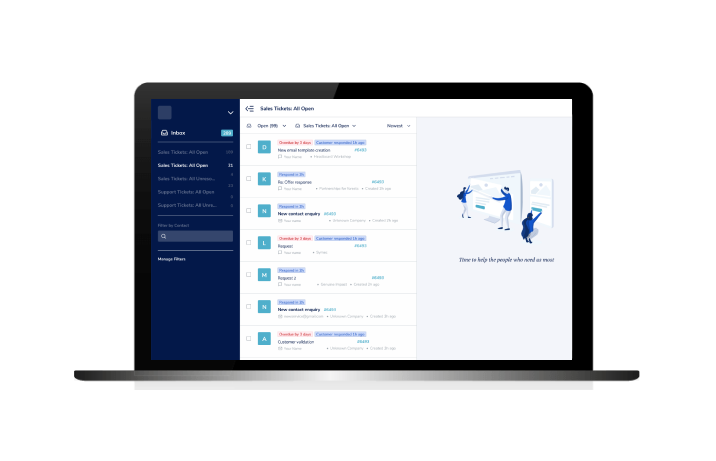

We specialise in creating unique business applications for the financial and banking sector. Our credit and banking products streamline credit and banking operations, providing features such as loan origination and management, collateral tracking, and powerful reporting. Designed for ease of use, these products integrate seamlessly with industry-leading platforms such as Microsoft Dynamics 365, SAP, Salesforce, and Fintech, providing secure real-time data visibility

Validation for B2B and B2C

Our data validation tailored for both B2B and B2C companies in real-time ensures accuracy, reduces errors, and minimizes fraud risks, while providing customization to meet specific business needs. Whether we’re verifying partners and suppliers for B2B or authenticating customer information for B2C, our solutions improve decision-making and security in a rapidly evolving marketplace.

Security – On-Premises – Hybrid Setup

As businesses move to the cloud, security becomes a top priority. Our hybrid configuration provides the perfect balance, delivering the benefits of cloud computing while ensuring data security. Our business applications provide a secure and scalable platform whether you’re at your desk or on the go, ensuring your confidence in an ever-evolving business world.

Some of the automation for the Finance and Banking sector include:

Data extraction with OCR

This solution, based on optical character recognition (OCR), seamlessly extracts data from invoices and meticulously matches it to purchase orders using advanced algorithms and pattern recognition techniques.

Thus, our solution minimizes manual tasks up to 90%, saving time and reducing the risk of errors, ensuring accurate processing.

Accurate data collection and verification

Utilizing advanced data collection and verification methods, our bots automate the process of gathering and verifying borrower information, ensuring accuracy, and reducing the possibility of errors.

Innovative automation for bank statement conciliation

We have successfully implemented automation in bank statement conciliation. Our innovative bot can automatically download bank statements and compare them to the recorded transactions in the company’s accounting system. Any discrepancies are flagged for review, saving valuable time and reducing the possibility of errors.

Real-time loan term calculation with innovative algorithms

Our innovative algorithms enable real-time loan term calculations, empowering financial institutions to make swift, informed decisions. We streamline the loan approval process by generating essential documentation, delivering a superior experience for both institutions and borrowers.

Our bees at work

Got your interest?