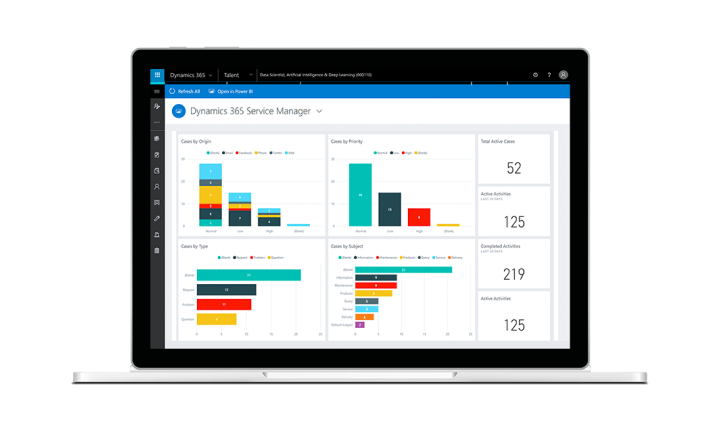

Our specialized CRM solutions, using Microsoft Dynamics 365 Service and Salesforce Service Cloud, are tailored to improve interactions and payment tracking, ultimately improving collection performance.

Key features include customer segmentation, automated communication, and payment tracking. Customer segmentation provides targeted messaging, optimizing engagement and payment rates. Automated communication simplifies payment reminders and confirmations, improving the overall customer experience. Payment tracking helps businesses manage their collections process from start to finish.